When running a business that holds stock — whether it’s finished products like bottles of wine, raw materials like barley, or packaging such as labels and bottles — it’s easy to focus on tracking inventory quantities. But there’s another piece of the puzzle that’s just as important: the cost of your inventory items.

This cost affects not only your stock valuation, but also your profit margins and overall financial reporting.

That’s why having a system that allows you to track and journal changes to item costs is essential for maintaining accurate accounts. Vinsight’s improved cost change tracking feature automates this process by creating a journal entry whenever you change the standard cost in a stock item. See Adjusting Standard Cost of a Stock Item.

Here’s why it matters — and how it helps.

🔍 1. Inventory Isn’t Just a Quantity — It’s a Value

Inventory is listed as a current asset on your balance sheet. Its value is based on the cost per item multiplied by the quantity on hand. So when the cost of an item changes — due to supplier price changes, manufacturing costs, or even currency fluctuations — that value needs to be updated.

If you only adjust the quantity and ignore cost changes, your inventory value will quickly become inaccurate. And that leads to misstatements in your financial reports.

🧾 2. Journaling Cost Changes Keeps the Books Balanced

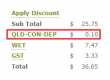

When the cost of an item increases or decreases, you need to make an accounting entry (a journal) to reflect that change. For example:

- If the cost of an item increases, your inventory asset increases.

- To keep your books balanced, you record the offsetting entr, for example to an expense account, like “Inventory Cost Adjustment.”

This ensures that every change in inventory value is matched by a corresponding entry for example in your Profit and Loss (P&L), helping you maintain clean, auditable records.

📊 3. Better Insight into Profit Margins

Accurate item costs mean accurate margins. If you’re selling products based on outdated cost values, you might think you’re more profitable than you really are — or worse, you could be losing money without realizing it.

By tracking cost changes and journaling them properly, you ensure your margins reflect real costs, leading to smarter pricing, purchasing, and planning decisions.

✅ 4. Improves Accuracy at Month-End and Year-End

Month-end and year-end financials rely heavily on correct inventory valuation. If your stock value is off due to unrecorded cost changes, your balance sheet and income statement will both be inaccurate.

By journaling cost adjustments regularly, you reduce the need for last-minute corrections — and make life much easier for you or your accountant at reporting time.

✍️ Final Thoughts

For producers in the wine, beer, and spirits industry, inventory is a dynamic asset — with fluctuating costs tied to raw materials, bulk production, and finished goods. Tracking cost changes is crucial to ensuring your accounts are accurate and your margins are clear.

Use the data created by Vinsight’s improved cost adjustment feature to create journals and seamlessly integrate this data into your accounting system.

It’s a small habit with a big payoff for clean, confident accounting.